Portfolio

Portfolio

Founded in 1994, Phoenix Investors and its affiliates (collectively “Phoenix”) are a leader in the acquisition, development, renovation, and repositioning of industrial and data center facilities throughout the United States.

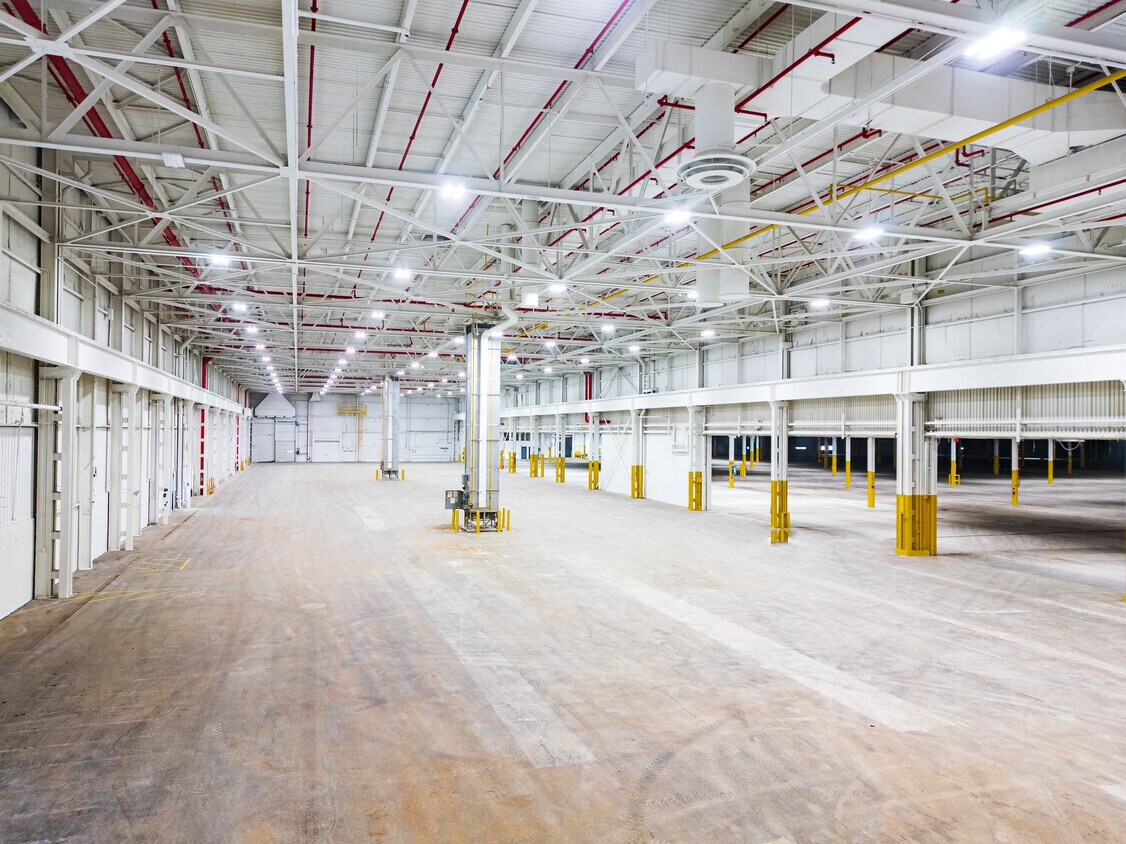

Greenwood,

South Carolina

380,484 Available SF148.79 Acres

Phoenix Investors Leasing Team

Our Expanding Portfolio

Affiliates of Phoenix’s portfolio spans 27 states and includes commercial properties totaling 85 million square feet. Our entities have a strong, diversified mix of locations, tenant credits, and property types. Given current macroeconomic conditions and recent shifts in retail spending habits, our current investment strategy generally will be to cycle out of big-box, single-tenant retail (where appropriate) to invest in larger value-added industrial and data center facilities. Additionally, on a case-by-case basis, we will continue acquiring distressed retail and office properties, along with other REO, as opportunities are identified.

Investment Types

- Industrial properties greater than 200,000 SF with specific preferences for emerging industrial corridors

- Manufacturing facilities revitalized to serve as valuable industrial assets, including data centers and other use cases

- Value-added commercial real estate opportunities for most property types, with the exception of multifamily properties

- Portfolios with a mixture of stabilized and vacant properties

- Land for commercial development considered on a limited case-by-case basis

Deal Types

Broad structural flexibility, including traditional sales, seller financing, trades, joint ventures, note sales, etc. We understand the challenges of today’s marketplace and actively seek both traditional transaction solutions and more outside-the-box solutions.

Yield Requirement

Determined case-by-case and based upon risk assessment.

Locations

Primarily focused on the Midwest and South, with the ability to acquire nationally; secondary and tertiary markets are considered.